Property Search

Assessment Inquiry

Greetings from the Milton Township Assessor’s Office!

It is with great pleasure and a sense of duty I extend a warm welcome to you on behalf of the Milton Township Assessor's Office.

I am privileged to serve as your Township Assessor, overseeing the task of identifying all taxable properties within Milton Township and establishing fair and accurate taxable values for each property subject to taxation. With a vast count of forty-one thousand parcels, we proudly stand as one of the largest townships in DuPage County.

My dedicated team and I are committed to serving the Milton community with professionalism, integrity, and accuracy in assessing property values. Our goal is to instill public trust and confidence by delivering fair and equitable assessments.

We are here to assist you in obtaining the information you need related to your property. Feel free to reach out to us with any questions or concerns; we are at your service.

Our website has been designed to empower property owners with valuable information about assessments in their neighborhoods. Just like any thriving platform, we consistently monitor and update information to foster a deeper understanding of assessment values within Milton Township.

As you navigate through our website, we encourage you to share your thoughts and suggestions on how we can better serve you. Your input is invaluable and contributes to the continuous improvement of our services to the residents of Milton Township.

Please do not hesitate to contact us anytime; we are here to assist you in any way we can.

Sincerely,

Chris E. LeVan, CIAO

Milton Township Assessor

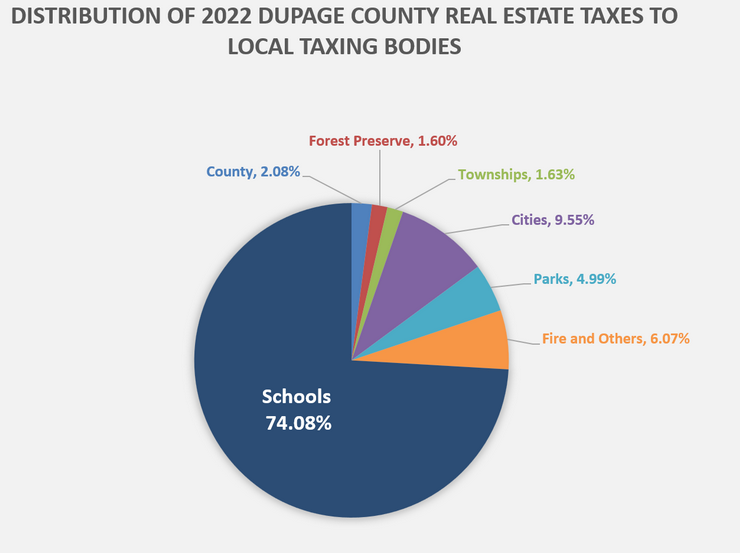

Source: DuPage County Treasurer

Source: DuPage County Treasurer

Latest News

What we are working on now:

The 2023 assessment year is the first year in the four-year cycle that runs from 2023 through 2026. The courts have ruled that a General Assessment Year is to be treated differently from a non-general-assessment year. In the 2023 general assessment year, the law requires that we view and determine as near as practicable the value of all 41,000 +/- properties listed for taxation as of January 1 of that year, and assess the property at 33 1/3% of its’ fair cash value.Additionally, we will be analyzing sales data over the past three years [2020, 2021, 2022] and adjusting assessments as necessary. Our office adheres to the state property tax code (35 ILCS 200/1‐1, et seq.) and the applicable regulations provided in the Illinois Administrative Code.